Travel insurance for the United States

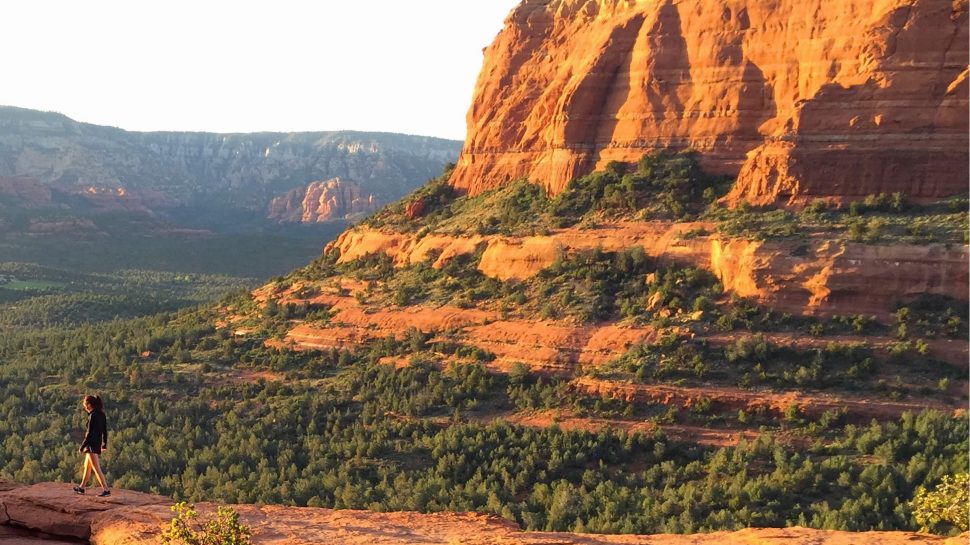

The United States offers a whole world of experiences in just one country. From the soaring skyscrapers of New York City to the rhythmic soul of New Orleans and the untamed vistas of the western deserts, it's a destination where every traveller can find their perfect escape.

Amidst the excitement, it's crucial not to overlook the importance of travel insurance. Unforeseen events can occur, from travel delays to the need for medical care, and you could find yourself facing hefty expenses without proper coverage. So, while you savour your United States journey, our array of travel insurance policy options can help to relieve the extra worry of certain unexpected challenges.

What do I need to consider before purchasing travel insurance for the United States?

Before setting off on your American holiday, consider these key points when choosing travel insurance.

Local conditions

Stay updated on the conditions in the USA, particularly in places you plan to visit. In such a large country, it can be easy to miss events in specific areas, such as festivals and parades, sporting events, protests, potential political unrest or even natural disasters that might impact your travel plans. Websites like Smartraveller.gov.au provide valuable insights, travel alerts and advisories for Australian travellers.

Travel plans and activities

Whether it's hiking in national parks, enjoying city tours or finally going on that great American road trip, check that your travel insurance policy covers your holiday activities. Check the Product Disclosure Statement (PDS) to determine whether you need additional coverage.

Protect your belongings

The USA offers world-class shopping experiences, though it's equally important to safeguard your current possessions from petty theft. Approximately one-quarter of all claims received are due to lost luggage or travel documents. Our international comprehensive plan covers loss or theft of personal items and electronic gadgets, and you can increase the coverage limit(s) for an additional premium.

Comprehensive cost assessment

Factor in the total cost of your trip, from flights to accommodations and attractions. This way you can make sure you have a comprehensive travel insurance policy that meets your specific trip requirements and may help cover costs that arise due to travel delays, cancellations or changes.

Healthcare and medical needs

The United States healthcare system can be expensive for tourists. Consider a policy that includes overseas medical coverage for costs that may arise from medical care, medical treatment and medical emergencies. It’s important to understand the exclusions, especially for anyone travelling with pre-existing medical conditions.

What should my travel insurance to the United States include?

A suitable travel insurance policy should include benefits that offer protection against theft, trip cancellation and delays in specific situations, and includes immediate access to emergency assistance should the need arise during your exploration in the United States. Check the PDS to determine which Australia Post travel insurance policy is right for you.

Protection against theft

While travelling, the risk of theft remains a concern. If your personal items like handbags, luggage, credit cards or passports are stolen, our travel insurance policy options can help cover you in this situation.

We offer compensation or replacement for lost, stolen or damaged items such as smartphones, cameras, laptops and other electronics, subject to certain limits. For high-value items like designer accessories or specialised electronic gear, we provide options to enhance coverage and safeguard your belongings.

Access to healthcare services

In the unforeseen event that you sustain injuries from an adventure, or even fall ill from unfamiliar foods, policyholders have access to our Virtual Care services, which can provide consultation with an Australian-based GP for expert medical advice, no matter where you are in the States.

Coverage for unforeseen plan changes and cancellations

Travel plans can be unpredictable, and changes can occur for various reasons, including altered government travel advisories or extreme weather events.

Unfortunately, the US is no stranger to natural disasters such as tornadoes, hurricanes, blizzards and forest fires. If the area you’re planning to visit becomes affected and you need to cancel or change your booking, our travel insurance provides some cover in the event of a natural disaster. This may offer financial protection against extra costs that might arise.

Travel tips for the United States

Stay informed

Keep up to date with local news and current travel alerts in the areas you're visiting. Use reliable sources such as Smartraveller.gov.au for real-time information on safety and services.

Cultural sensitivity

Like Australia, the US offers a rich blend of diverse peoples and cultures. So, respect local customs and be mindful of your behaviour in public spaces. When travelling to foreign countries, it’s better to err on the side of caution regarding public behaviour.

United States tipping culture

Ensure you carry cash for tipping staff at bars, hotels and restaurants in the US, as it's a customary practice to show appreciation for good service. Generally, it’s customary to leave a tip ranging from 20-25% on the bill (pre-sales tax), with additional amounts for exceptional service or in line with the establishment's standards.

Health precautions

Consult your healthcare provider for advice and necessary vaccinations. Carry essential medications and a basic first-aid kit.

Secure your belongings

Be vigilant with your possessions, especially in crowded areas or while using public transport. Keep your passport in a safe space, perhaps in your interior coat pocket.

Documentation and safety copies

Keep copies of important travel documents like your passport and insurance policy. Share your itinerary and emergency contacts with someone trustworthy.

Exploring the US can offer a truly enjoyable and enriching travel experience. With comprehensive travel insurance, you can relish everything from the hustle and glam of Manhattan to the tranquillity of the Pacific Coast, knowing that you have coverage in place. For a full list of cover provided please read our PDS (PDF 696kB).

Limits, sub-limits, conditions, exclusions and fees apply. Policies may not be available to all travellers. Australian Postal Corporation (ABN 28 864 970 579, AR No 338646) is the distributor of Australia Post Travel Insurance and is an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340 AFSL 457551). Travel insurance products are underwritten by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507). Consider your financial situation, needs and objectives and read the relevant Product Disclosure Statement and Target Market Determination before deciding to buy this insurance. For more information on these products, please contact us on 1300 728 015 or email auspost@travelinsurancepartners.com.au